Battery prices won’t fall until 2024

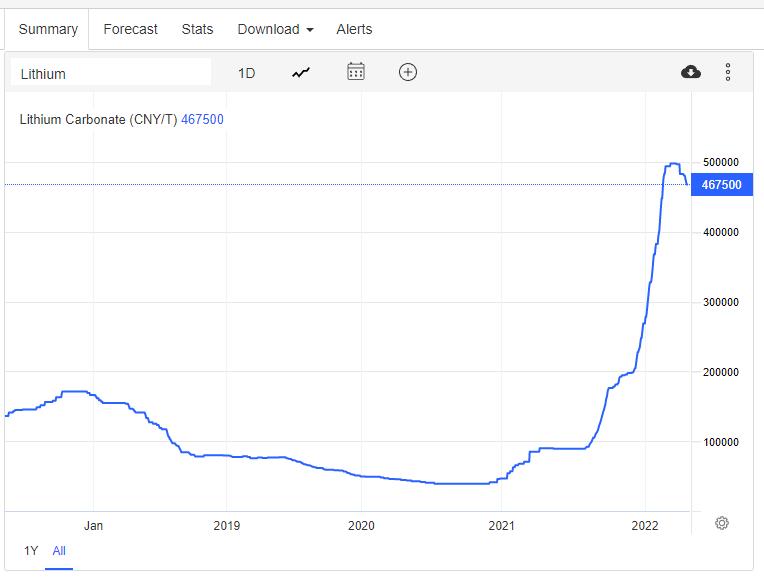

China's lithium market is set to face tightening supplies throughout 2022 as the demand-supply mismatch widens, a development that is likely to keep domestic prices at elevated levels, according to the S&P Global Platts China Battery Metals Outlook for 2022.

As battery production capacity continues to expand, fueled by expectations of strong electric vehicle sales against the backdrop of intensified decarbonization efforts, it is almost a certainty that China's demand for lithium will increase further this year.

EV demand drives prices

In the Platts survey, a total 80% of the respondents expected that China's average battery-grade lithium carbonate prices in 2022 would be higher than Yuan 250,000/mt ($39,354/mt), about 316% higher from what it was at the start of 2021.

Smart customers have already stocked battery inventories as soon as possible and are ready to make a fortune.